Client Name

Andre Eduardo

Business

Trade your physical items in the form of NFTs on Web3

Country

Dubai/Malta

Website

www.realworld.fi

Description

End-to-end trading solutions to facilitate and join in a revolutionized borrowing and lending world.

Services

NFT Borrowing, lending, and Trading platform

Industries

Decentralized Marketplace for Real-World Asset NFTs

Team

Backend - 1

Frontend - 1

UI/UX Design - 1

QA - 1

Smart Contract - Solidity - 1

PM - 1

Tech Architect - 1

About

Storing, Minting, and Selling Products with the Blockchain based NFT Marketplace Case Study

Real World is a groundbreaking platform that leverages the Polygon network to tokenize real-world assets, transforming them into Non-Fungible Tokens (NFTs). This innovative concept allows anyone with access to the platform to buy, sell, and participate in bidding for these tangible assets represented in the digital realm. This Real-world NFT Marketplace revolutionary approach bridges the gap between physical and digital ownership, empowering users to trade and own a diverse range of real-world assets in a secure, transparent, and decentralized environment.

By converting real-world assets into NFTs, Real World unlocks new possibilities for investors, collectors, and enthusiasts alike. Tangible items like artwork, real estate, collectibles, and even intellectual property can now be seamlessly transacted digitally, offering increased liquidity and accessibility.

Through Real World's user-friendly interface, individuals can explore a diverse marketplace of unique and valuable assets, each represented by its own distinct NFT. Collectors can confidently acquire these NFTs, knowing they hold verifiable ownership over the underlying assets, and each asset will be appraised by a qualified professional. Creators benefit from a wider market reach, enhanced marketability, and the ability to sell high-value items, democratizing access to premium assets fractionally.

As the platform continues to expand and innovate, it promises to reshape traditional marketplaces, offering a glimpse into a future where the possibilities are fully harnessed.

Business Goal

From Real to Virtual - Real-World NFTs Pioneering the Future

- The Primary objective of real-world NFT is to tokenize a wide range of real-world assets. By turning tangible assets into NFTs, it aims to create a bridge between the physical and digital worlds, enabling users to buy, sell, and trade these assets efficiently.

- Real-world NFTs introduce automatic royalty payments to the original owner on each subsequent resale of the NFT. This revenue-sharing mechanism incentivizes creators, collectors, and dealers, offering them a continuous stream of income from their assets.

- Leveraging the Polygon network, a Layer 2 scaling solution for Ethereum. By utilizing Polygon, the platform offers faster transaction speeds and significantly lower gas fees compared to the Ethereum mainnet, providing users with a more cost-effective and efficient experience.

- It prioritizes compatibility with popular decentralized wallets like Metamask and platforms that support WalletConnect. Seamless integration enhances accessibility and allows users to interact with their NFTs across various blockchain applications and ecosystems.

- The platform offers NFT lending and borrowing where users can participate as both borrowers and lenders, creating a dynamic ecosystem.

- Ensuring the security and authenticity of NFTs is a fundamental goal. By utilizing a polygon network, Realworld NFTs establish transparent and tamper-resistant records, building trust and confidence among users.

By effectively pursuing these business goals, real-world NFTs can establish themselves as a leading platform in the NFT space, catering to a broad audience of creators, collectors, investors, and enthusiasts seeking to participate in the exciting world of real-world asset tokenization.

Challenges/Developing Challenges

The Next Frontier - Real-World NFTs Encounter Challenges!

Tokenizing real-world assets as NFTs can involve navigating complex legal and regulatory frameworks. Ensuring compliance with various jurisdictions' securities, property, and intellectual property laws can be challenging.

If the borrower fails to make timely loan payments or violates the terms of the loan agreement, the lender may take possession of the NFT and sell it to recover the outstanding loan amount. The borrower could risk losing ownership of the NFT if they default on the loan.

In the real-world NFT marketplace, protecting users' digital assets and personal information is paramount. Robust security measures must be in place to mitigate the risk of hacks, cyberattacks, and phishing attempts.

It's crucial for both borrowers and lenders to carefully review and understand the terms of the loan agreement to ensure a smooth and transparent repayment process. Borrowers should be diligent in making repayments on time to avoid default and the potential loss of their NFT collateral. Lenders, on the other hand, should exercise due diligence in setting fair loan terms and evaluating the value and marketability of the NFT collateral.

Solution, Achievements

NFTs: Connecting Real and Virtual, Creating Endless Possibilities

Real World NFTs provide an innovative solution to tokenize real-world assets into NFTs on the Polygon network. This bridging of the physical and digital realms unlocks new possibilities for asset ownership, trading, and liquidity.

Facilitate the automatic billing of transaction fees, like royalties or storage costs, during the lifetime cycle of the item in the secondary market.

NFT marketplace offers a secure, transparent, and decentralized marketplace for users to buy, sell, and bid on a diverse range of tangible assets represented as NFTs. This empowers individuals, artists, collectors, and entrepreneurs to participate in the digital asset economy.

The platform enforces automatic royalty payments to the original asset owner on each subsequent resale of the NFT. This novel feature incentivizes creators and collectors, providing them with a continuous income stream from their assets.

Profit from joining a community, participating in, and contributing to the growth of a DAO that would harness the power of derivatives of real-world NFTs.

Real World NFTs enable fractional ownership, allowing multiple users to share ownership of high-value assets. This feature enhances liquidity, broadens user participation, and democratizes access to premium assets.

Discovery, Workflow(Design process)

Working Of Real World NFTs

- Sitemap

- IA

- Journey map

Real World NFTs

Design Screens

Design Screens

Working Module of Real World NFTs

Here are the working modules of the real-world nft marketplace case study mentioned below:

Admin Dashboard

Fees Management

Platform Fees Management 1

Admins can set and manage the fees charged by the platform for various transactions, such as buying, selling, or transferring NFTs. This includes defining fee percentages or fixed amounts for each transaction type.

Royalty Fees Management 2

Admins can configure and monitor royalty fees applied to NFTs. This allows creators to automatically receive a percentage of subsequent sales as part of the royalty program.

Collection Management

Delete Collections 1

Admins have the authority to delete or disable specific NFT collections on the platform as needed.

Whitelist Address 2

Admins can whitelist specific wallet addresses, granting them exclusive access or privileges on the platform. This is useful for verified users or partners.

Royalty Splitter 3

Admins can configure the distribution of royalty fees among multiple beneficiaries, such as creators, presenters and stakeholders. The royalty splitter ensures transparent and accurate royalty sharing according to predefined rules.

NFT Trait 4

Admins can define and manage different traits or attributes associated with NFTs, adding further value and uniqueness to the assets. This feature enables users to filter and search for NFTs based on specific traits.

Collections 5

Admins can create, delete, and manage different NFT collections, each representing a distinct group of assets, such as art, real estate, or digital collectibles. This helps users discover relevant NFTs efficiently.

Borrow and Lend 6

Admins can oversee the borrowing and lending processes on the platform. However, the process of lending and borrowing happens trustless through smart contacts. The lender sets the terms of the loan and borrower can negotiate through counter-offers before accepting the deal.

Loan Duration 7

Admins can define the duration for which assets can be borrowed or lent on the platform. They can set specific loan periods or allow users to choose from a range of available loan durations in a few days.

DApp

Create Collection 1

This feature empowers users to easily curate their own NFT collections. Users can define a collection name, and description, and choose attributes and royalty fees.

Edit Collection 2

With this functionality, users have the flexibility to update and fine-tune their existing NFT collections. This includes modifying the collection details and making adjustments to the collection's attributes.

Create NFT 3

This feature allows users to mint new NFTs and convert their real-world assets or digital creations into unique tokens on the polygon network.

Edit NFT 4

Users can utilize the "Edit NFT" functionality to modify the attributes, metadata, or multimedia content associated with their existing NFTs. This flexibility ensures that NFT owners can update and improve the details of their assets, making them more appealing to potential buyers and collectors.

Burn NFT 5

This feature allows NFT owners to permanently remove their tokens from circulation. When an NFT is burned, it is effectively destroyed, reducing its supply and potentially increasing the rarity and value of the remaining tokens within the collection.

Royalty Release 6

This functionality enables NFT creators to release royalty payments to themselves or other beneficiaries automatically. Users can release royalty payments themselves through the platform using their Web3 wallet, however, the royalty percentages will be set by the admin.

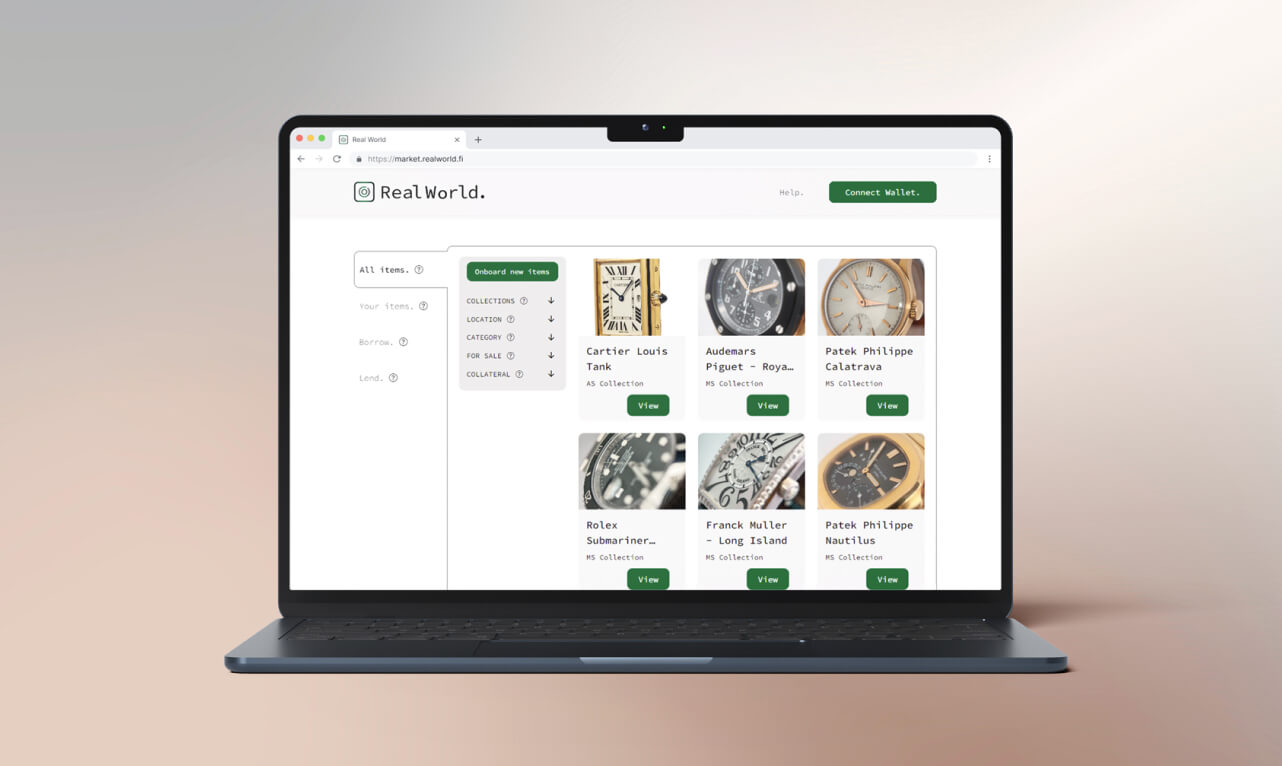

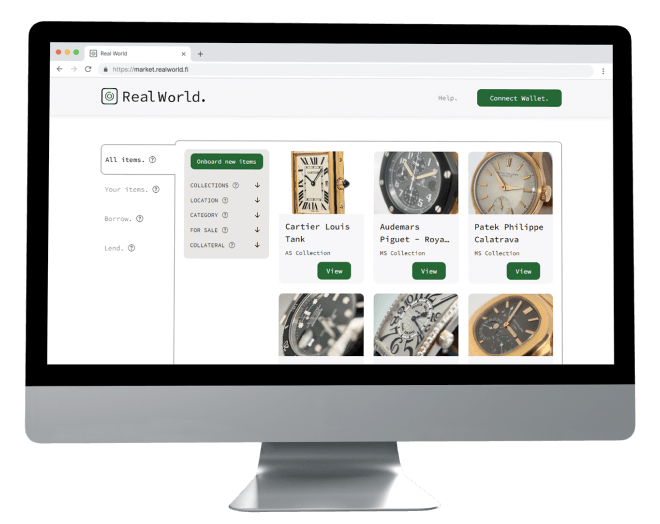

User - Marketplace

All Items 1

Real World NFT provides a comprehensive view of all the NFTs available on the platform. Users can browse and explore a diverse collection of NFTs, ranging from digital art to virtual real estate, collectibles, and more. Here, Users must pick these categories based on their criteria.

- Collections

- Location

- Category

- For Sale

- Collateral

Your Items 2

It provides a personalized view of the NFTs owned by the user. This includes NFTs minted or acquired by the user, providing easy access to their digital asset portfolio. Here, Users must pick these categories based on their criteria.

- Collections

- Location

- Category

- For Sale

- Collateral

Borrow 3

It offers users the opportunity to access borrowing services for obtaining loans against their NFT assets.

New Loan

Your Loan Request History: This section presents a record of the user's past loan requests, including approved, pending, and declined loan applications.

Select Assets for Collateral: Here, users can choose specific NFTs from their collection to use as collateral for borrowing activities.

Borrowing Activity

Your Live Borrowing: Users can view and manage their active borrowing agreements, including the loan amount, repayment status, and terms.

Active Negotiations: In this section, users can monitor any negotiations related to their borrowing activities.

Closed Borrowing: It presents a historical overview of past borrowing agreements that have been successfully repaid and closed.

Lend 4

Your Lending Opportunities: This section provides an overview of the user's current active lending engagements, including details of the assets lent and the associated lending terms.

Lending Activity

Your Live Lending: Users can view and manage their current active lending agreements, including the lent assets, interest rates, and repayment status.

Active Negotiations: Here, users can monitor active negotiations related to their lending activities.

Closed Lending: The category presents a historical overview of past lending agreements that have been successfully completed and closed.

Unique Features

Unique features of Real world

- Real-World Asset Tokenization

- Polygon Network Integration

- Royalty Payments

- Fractional Ownership

- NFT Collateral for Loans

- Secure and Transparent Provenance

- Seamless Wallet Integration

- Diverse Marketplace of Real-World Assets

- Borrowing and Lending platform

Tools

Tech Stack

Front End

Bootstrap

Angular

Back End

Node

Database

MongoDB

Smart Contract

Solidity

Blockchain

Solidity

Solidity

Read what our valued clients have

to say about us

Sparkout initiated and successfully introduced Parkk's Android and iOS app, building it entirely from the ground up. Beginning with the initial phase of UX/UX app screen design, the project progressed through development over a one-year timeline. The delivered solution was of high quality, making it well-suited to present it to investors and ensuring stability for a successful live market launch.

Jason

CEO, Parkk | USA

In collaboration with Sparkout, we executed a comprehensive delivery solution tailored and localized for Argentina within approximately five months. Throughout the implementation process, they effectively addressed and resolved all technical issues that emerged, ensuring a smooth and successful deployment.

Daniel G. Camps

CEO, TODO Delivery | Uruguay

I highly commend the Sparkout Tech Solutions team for their patience, dedication, and professionalism. Choosing your company to develop our Food Delivery product was a wise decision.

Senthil Kumar

CEO, Box Food | India

The Communication was friendly and straightforward, the service was prompt, and the team demonstrated high skills and reliability.

Kestas

Big Time Token

Results

Real-world nft marketplace case study - What is it about to?

Real-world NFTs embark on a path of continuous innovation and expansion, paving the way for a future where the boundaries between physical and digital ownership blur. As the platform evolves, it promises to reshape traditional marketplaces and unlock untapped opportunities for creators, collectors, investors, and enthusiasts.

Step into the Real World NFT marketplace and join this exciting adventure that brings art, real estate, collectibles, and intellectual property into the metaverse, offering a glimpse of the incredible possibilities that await in this dynamic and immersive digital landscape. Embrace the future of asset ownership, where the virtual and physical worlds seamlessly converge in the decentralized and interconnected realm of real-world NFT.

Take a peek at our blogs on

everything tech

A collection of highly curated blogs on the latest technology and major industry events. Stay up-to-date on topics such as Blockchain, Artificial Intelligence, and much more.

View all blogs